Best Payroll and Benefits Software Solutions in 2025

An unbiased review of the best payroll and benefits software, handpicked by SSR payroll experts.

Best Payroll and Benefits Software

Payroll processing and employee benefits go hand in hand, but not all payroll software can nicely handle both. We've been reviewing payroll software since 2018 and have checked out hundreds of options – that's what led us to make this buyer's guide.

Read on to find out which platforms that are great at both payroll and benefits, plus expert advice on picking the right vendor, things to watch out for, major benefits, and pricing.

To select the best payroll and benefits software and to ensure we specifically list products offering this combination of functionality rather than general payroll software, we did demos, conducted user interviews, and tested dozens of tools that met the basic requirement. The ones that made the cut excel particularly in three key factors: ease of use, payroll automation, and benefits packages.

- Ease of use: The sweet spot is a tool where everything is easy to figure out; you’re not overloaded with buttons and text, yet you don’t sacrifice robustness and capabilities. These tools are all remarkable in the way they solve this challenge.

- Payroll automation: Something is not quite right if a payroll tool doesn’t let you automate a good portion of the job with confidence. We prioritized vendors who are pushing the envelope here.

- Benefits packages: To be a best-in-class payroll and benefits tool, the benefits module needs to go beyond the basics. Tools that just do 1-2 benefits on top of payroll don’t cut it. We’re looking for those that offer good variety, and even for international teams, on top of a world-class payroll product.

To learn more about our process for vetting software companies, you can read this blog on how we evaluate HR tech vendors.

Need Help? Talk to an HR Software Advisor!

Tell us more about your company & an HR Software Advisor will help you find the right software

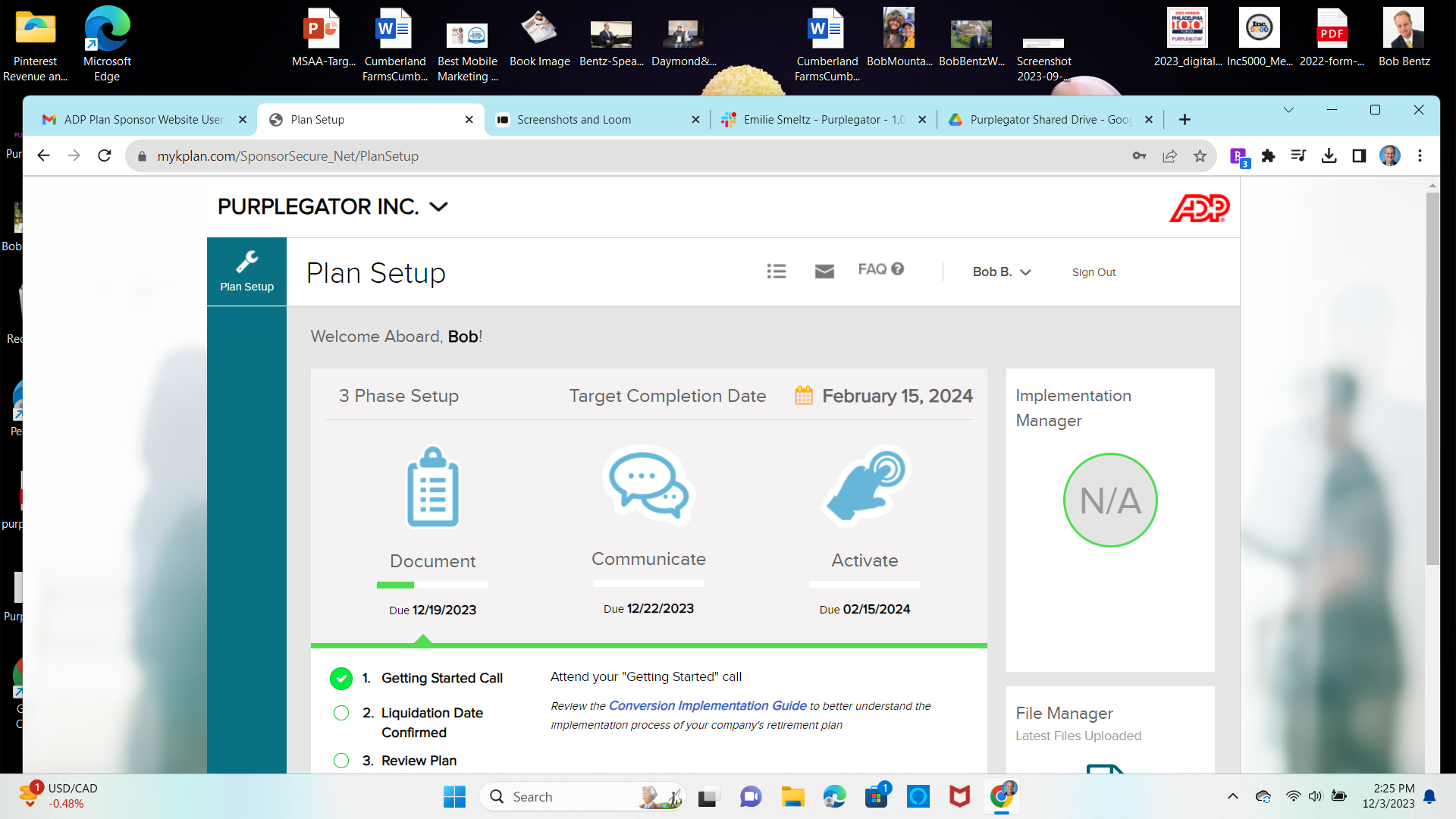

ADP

Possibly the longest-standing company in the payroll market, ADP deserves a mention. Their breadth of features includes many other HR workflows which fit enterprises and SMBs alike.

PROS

- Native, all-in-one technology suite for recruitment, payroll, and compliance.

- 17 RPO service centers in 14 countries and provide services in 42 different languages.

- Dedicated team of AIRS-certified recruiting professionals.

CONS

- Technology options outside ADP’s dedicated HR tools are limited.

ADP is perhaps the best known company in the payroll space. Given their scale, they can offer just about everything your business needs when it comes to payroll and benefits.

The Boston Globe, Whole Foods, The Bancorp, BP, Douglas Ellman Real Estate, Margaritaville, LongHorn Steakhouse

Sometimes ADP has special offers, like getting 3 months free when you sign up for their small business payroll processing plan. However, they don't share the prices for their payroll packages, so you'd have to request a quote to move forward.

Best For

ADP is a good bet for companies of many sizes, but they’re certainly not the most self-service product out there. Their products are worth looking into if you’d prefer to have professionals work with you on setting up payroll.

The company used ADP for payroll. It also uses it for 401k retirement programs. Our HR department has been happy with it. ADP has provided nice incentives to move to it.

Easy to use. Provided sign up incentives. Respected brand.

Colleagues had experience with ADP in the past and were lobbying for the company to make a change. We have made that change and then continued to increase the services that we were obtaining from them. It has been a positive experience. The vendor is exceeding our expectations. We don't foresee making changes in the near future.

It is a big company so you don't always feel like an important customer. We often deal with different people at the company. It would be nice to have one consistent contact.

The breadth of products that it offers is important to us. We know it has quality products and services.

A company with a long track record. Incentives to move to it. Suggested enhancements to the products.

It is continually updating its service offerings with improvements. It contacts us for associated products and services that may assist our business.

Small to medium business.

I cannot think of any.

Gusto

Gusto is a versatile solution: flexible pay schedule options, payroll deductions, automated tax filing, benefits, self-service, and more. SMB users particularly appreciate its compatibility for both W-2 employees and domestic and international contractors.

PROS

- Gusto payroll works for U.S.-based workers (W-2 employees and contractors) and for international contractors.

- The software supports online signatures and automated tax filing.

- Flexible payroll options accommodate different schedules and unlimited pay runs.

- Automatic deductions streamline benefits administration.

- Phone support, email, and customer service resources are available.

- Licensed benefits advisors are accessible to all plan users.

- Transparent pricing with no long-term contracts and no account setup fees.

- The dashboard feature keeps tabs on compliance tasks

- The hiring and onboarding sequence is nicely streamlined between HR and the new hire

- Post-offer, pre-start tasks are made easy with integrations like CorpNet (state tax set up) Checkr (background checks)

- Easy payroll for U.S.-based W-2 folks, domestic, and international contractors

- Person-to-person phone support, email, and other customer service resources

- The business model is responsive to customer needs

CONS

- No payroll support for international employees.

- There is no native accounting feature for tracking earnings and spending.

- Simple plan lacks native time tracking and online signatures, requiring third-party integrations.

- The analytics dashboard is basic.

- Federal/state compliance alerts and existing broker/health insurance integration require the Premium plan or add-ons.

- A free trial is not available.

- Gusto can support payments for international contractors, but not employees

- No native accounting feature to keep earning and spending under the same roof

- Analytics dashboard is simplistic

We have found Gusto to be a versatile payroll and benefits software that caters to the needs of small and medium-sized businesses.

One of the standout features of Gusto is its support for W-2 employees and domestic and international contractors. The software's capabilities extend beyond payroll, providing support for online signatures and automated tax filing, which streamline administrative tasks. We have a weak spot for flexibility, and Gusto doesn’t disappoint us by providing different pay schedules and unlimited pay runs.

Gusto has also known among HR folks for its support responsiveness. The platform provides phone support, email assistance, and licensed benefits advisors for all plan users to ensure that users can receive prompt service when needed. It also is praised for having a transparent pricing structure, eliminating long-term contracts and account setup fees.

However, it's important to note that Gusto does not currently support payroll for international employees. Additionally, the software lacks a native accounting or spend management features, so users must rely on third-party integrations.

The analytics dashboard, while functional, may be considered basic. And please be aware that federal/state compliance alerts and integration with existing brokers are exclusive to Gusto’s highest tier plan or available as add-ons.

A free trial is not an option here, limiting the opportunity for businesses to explore the tool before committing.

We are excited to announce that Gusto now serves more than 400,000 customers nationwide! Please update any and all references of "300,000+ customers" to "400,000+ customers"

Gusto is increasing our Simple Plan’s pricing from $40 per month + $6 per person per month to $49 per month + $6 per person per month (a $9 increase in monthly base).

Best For

Gusto offers an affordable basic plan, making it accessible for budget-strapped startups. Additionally, the top-tier Premium plan is an excellent choice for SMBs with available capital to invest in human resources, particularly if they have a small HR department.

I use Gusto daily for various HR and payroll-specific tasks. When an applicant has made it through the interviewing and screening process, I send an offer letter using Gusto. I also send a background check through Gusto's provider, Checkr.

After the applicant accepts the offer and completes the background check, Gusto walks me through the hiring and onboarding process for the new employee. I enter worksite-specific information such as the new employee's supervisor, which department they will be working in, assign risk class codes for worker's compensation, and assign any company-paid time off/sick time policies to their file so that these will accrue during each payroll.

The applicant is then invited to enter their personal information so that we can complete their I-9 and sign them up for direct deposit, wage withholding with the W-4 form, etc.

Gusto has a user-friendly and intuitive interface for basic payroll and onboarding functions. Their app is easy for our employees to understand and navigate. They integrate with several other third-party apps, such as Checkr for background checks and Guideline for 401k plans.

My company purchased Gusto because it was recommended to us by our CPA as a great payroll provider for small businesses. We needed to find a way to automate as much of the payroll process as possible. We looked for software that would file new hire reports for us, automate the onboarding experience, and pay our employees accurately and on time. We also needed something easy to use and that had the option to integrate with other frequently used apps. I have used Gusto for over two years.

I have experienced several "bugs" when we have unique issues with employees, such as messages indicating an overdue payroll from a year previous after entering an employee's promotion. Their customer service team is available during business hours for calls, but I have been given inadequate solutions several times when speaking with one of these representatives. Their reporting function is very limited and doesn't allow for complex custom reports.

Gusto is an affordable solution for small businesses that don't require complex reporting. If you have a company with 50 employees or less, it may be a great solution. I have used other payroll and HRIS systems, such as ADP, Paychex, and Paylocity, which have more advanced capabilities, and I would recommend one of those for mid- to large-sized companies. The biggest difference between Gusto and these other systems is the ability to create custom reports and formulate data analytics as a tool for talent acquisition planning.

If you're in the market for a tool like this, consider the size of your business and what you will be using the tool for. If you're operating a small business and just want the basics covered, a platform like Gusto may be affordable and practical. If you want the ability to create data analytics and grow your talent, you'll need a system with advanced custom reporting capabilities. Government-required reports such as OSHA 300 and annual EEOC reporting will require data each year, so you'll want to have a tool to handle these needs without manual number crunching.

Gusto meets virtually with customers on a quarterly basis to review their accounts and ensure customers are aware of all the capabilities they have access to. They accept feedback and send ticket requests to their support team for consideration when updates are requested. Since I started using Gusto, they've expanded by giving companies the ability to address employee performance, send out monthly anonymous employee surveys, and upgraded their payroll entry process so that data can be imported from other apps.

Small to mid-sized businesses without complex reporting needs will find Gusto very helpful.

Large businesses (100 employees or more) or those that want to create complex reports and utilize data analytics should look for more robust tools.

Paylocity

Paylocity is among the top payroll vendors in the US market thanks to its ease of use and excellent customer support. It’s also quite comprehensive, offering a range of tools from tax to global payroll management, and benefits administration.

PROS

- Paylocity’s customer support is highly rated for always being available to answer questions.

- Global payroll support for 100+ countries.

- Provides free and unlimited training modules on the website.

- Paylocity’s mobile app has a good UI and functionality

- The tool is easy to use for both employees and employers.

- Has 350+ pre-built integrations.

- Paylocity’s customer support is highly rated for always being available to answer questions.

- Global payroll support for 100+ countries.

- Provides free and unlimited training modules on the website.

- Paylocity’s mobile app has a good UI and functionality

- The tool is easy to use for both employees and employers.

- Has 350+ pre-built integrations.

CONS

- Undisclosed pricing.

- It doesn’t have a free trial or free plan.

- Support is available in English only.

- It isn’t the best solution for remote teams looking for a tool to manage payroll and benefits for their contractors.

- Undisclosed pricing.

- It doesn’t have a free trial or free plan.

- Support is available in English only.

- It isn’t the best solution for remote teams looking for a tool to manage payroll and benefits for their contractors.

Paylocity is one of the largest payroll providers in the United States but that’s not the main reason we were drawn to it. Our top deciding factors, instead, are its customer service, user-friendliness, and affordability.

We have heard a lot about Paylocity’s customer support, so we wanted to see it for ourselves. We got in touch with the Paylocity team to book a demo, and we really enjoyed the punctuality as they answered our questions and guided us through the software’s setup.

Paylocity is very user-friendly. We like that the ease of use applies not only to the web version but to the mobile app. It is particularly helpful for employees to access the self-service from anywhere to do a quick check on their payroll and benefits, make changes, and submit claims.

While not as advanced as some top enterprise-oriented payroll and benefits vendors, Paylocity’s reporting capabilities can be of benefit to mid-sized teams. There are a few reporting options to choose from or customize to track your benefits costs and see how employees are using their benefits. This information can be helpful enough in making decisions about benefit plans.

Though Paylocity doesn’t disclose its pricing on the website, businesses have praised the platform for its affordability compared to similar options in the marketplace.

Momentus, Watters, Weigel’s, ILC, Upward, HMC, Polywood.

The exact pricing of Paylocity's offering is not publicly-disclosed.

Best For

Paylocity is a great option for companies, ideally midsized, looking for an established payroll and benefits software tool that is budget-friendly, user-friendly, and has great customer service.

When I utilized Paylocity, it helped me monitor staffing numbers across each cost center. It assisted in recruitment efforts by allowing me to track staff levels at each store and determine whether we were meeting our hiring targets. It also helped identify stores that required more recruiting efforts and facilitated meetings with store managers to discuss needs and create plans to meet set goals.

Paylocity was also used for payroll purposes. Reviewing the rates for each cost center helped determine competitive target rates for each role within the stores. Regarding payroll, it managed PTO accrual and ensured employees were paid correctly for the hours worked.

Paylocity offers many pre-loaded reports, which were useful for targeting specific metrics. The interface is user-friendly and has many valuable features. Having the opportunity to participate in a demo with a representative to walk through Paylocity’s functionality was extremely helpful. Additionally, the function that automatically posts new vacancies to multiple job sites, like Indeed and Monster, was very convenient.

Our company switched to Paylocity after acquiring another franchise. The acquired company already used Paylocity, and it was part of the contract that we would keep and integrate it with our existing employees. I have used it for about two years. However, there were numerous issues on payday, with several instances where paychecks were deposited into the wrong accounts.

While customer support was promised to be excellent, it was often difficult to find solutions when problems arose. The demo of the software was impressive, and the sales team did a great job, which is understandable why people might choose it, but the ongoing functionality can become frustrating when the same mistakes occur repeatedly.

Customer service frequently experienced turnover, making it difficult to find knowledgeable support, which was frustrating. Often, I found that I knew more than the representatives assisting me. We also encountered several instances where an employee’s pay was deposited into the wrong account, which was a significant concern that needed prompt resolution. Lastly, the frequent misalignment of cost centers was a constant issue, taking up a considerable amount of time to correct.

Paylocity has a very user-friendly interface compared to other tools I’ve used. The ability to provide demo training for onboarding new corporate individuals from other brands was a great advantage. However, once our account manager left, it became challenging to bring new users up to speed.

Consider your organization’s specific needs and take detailed notes during demos. Paylocity offers many training advantages, but it’s essential to have clear expectations of what you need from the tool.

Before I left the company, there was talk of introducing a texting feature, which seemed like a valuable addition.

I would recommend Paylocity for larger organizations. It offers a wide range of features that can be useful for payroll, onboarding, recruiting, labor management, and more.

Smaller organizations might benefit from using a more affordable alternative to Paylocity.

.png)

Deel

.png)

Deel’s software was designed for payroll compliance in over 150 countries. It also incorporates some core HR features and has a notably easy-to-use interface.

PROS

- Deel excels in customer support, offering around-the-clock in-app help and an industry-leading 2-3 day onboarding speed. Users can also access local payroll experts across jurisdictions, which aids contractors in establishing themselves as LLCs, for instance.

- Integration with popular software like Quickbooks, Bamboo HR, and Greenhouse, along with customizable integrations, streamlines processes.

- Tech-enhanced self-service approach for quick setup. Identity verification is swift, often under 24 hours.

- Automated invoice generation for both company and contractor/employee sides.

- Excellent 24/7 customer service with fast onboarding (2-3 days) and local payroll experts in each jurisdiction.

- Deel HR is free for companies of all sizes.

- Seamless integration with platforms like QuickBooks, BambooHR, and Greenhouse, plus custom integration options.

- User-friendly, self-service features enable quick setup; identity verification often takes under 24 hours.

- Automated invoices simplify payments, provided they're in English.

CONS

- The benefits offered could be considered basic compared to more specialized vendors.

- Certain modules like onboarding automation are only offered as add-ons at an additional cost.

- Flexibility is limited in modifying contracts or service agreements; changes often require addenda.

- A $5 payout fee is applicable.

- Invoice generation appears to be available exclusively in English.

- Key features like onboarding automation are add-ons, which may increase costs.

- Limited flexibility in modifying contracts or service agreements; changes often require an addendum.

- Invoices cannot be generated in languages other than English.

Deel is one of the top companies for international payroll. If you have an international team of remote workers, it’s a tool that’s worth looking into. You can use it to hire people as contractors or as full-time employees through either the EOR or PEO offerings.

The tool itself is quite easy to use and ever-expanding. Since we first became familiar with the tool, Deel has grown to include basic HR features, as well as a myriad of other hiring workflows. These include background checks, equity plans, flexible workspaces, employee onboarding, visa and immigration consulting, and more.

35,000+ organizations, including Andela, HomeLight, and Makerpad.

Deel offers a range of payroll and benefits solutions, including:

- Deel Contractor: $49/month for compliance, payments, and contractor management in 150+ countries

- Deel EOR: $499/month for international hiring without an entity, including payroll, taxes, and benefits

- Deel Payroll: $29 per employee/month for payroll services in businesses with existing entities

- Deel US Payroll: $19 per employee/month for US-specific payroll, tax calculations, and compliance across all states

- Deel US PEO: $89 per employee/month for HR, payroll, and benefits in the US

- Deel Immigration: Custom pricing for relocation, visa sponsorship, and immigration management in 40+ countries.

Best For

Businesses with a mix of full-time employees, contractors, and freelancers overseas, especially those that require multi-country payroll, will benefit from Deel's payroll and benefits services.

Deel serves as our HRIS system for all personnel outside the US, including contractors and employees through EOR in countries like Armenia, Georgia, Kazakhstan, Mexico, and the Netherlands. We use it for payroll processing, employee tracking, managing time off, and ensuring legal compliance in each country. Compliance is crucial, as Deel helps ensure we adhere to local employment laws. Additionally, it manages expenses and other HR processes for our non-US employees.

Deel simplifies the hiring process, particularly for contractors, making it incredibly user-friendly. The compliance features are invaluable, keeping us informed of legal changes across different countries. Moreover, the platform itself is straightforward and easy to navigate.

Our organization needed a system that would enable us to quickly hire contractors in Europe while scaling with our growth. Deel was chosen for its clarity, ease of setup, and cost-effectiveness. Initially, it was used for managing our European contractors, but as we transitioned from contractors to full-time employees, Deel's capacity to handle EOR and contractors across multiple countries proved ideal. We have been using Deel for just over a year, starting with contractors and recently expanding to include EOR services for our European employees.

Navigating the platform can sometimes be confusing when trying to locate specific features. Currently, Deel does not support adding US employees, necessitating separate HRIS systems for our US and international staff. Additionally, we occasionally encounter unexpected fees.

Deel offers a more affordable solution compared to its competitors, although it's important to consider potential hidden fees. While the platform's overall look and functionality are similar to others in the market, the differences are relatively minor.

When considering a tool like Deel, evaluate your hiring needs outside the US. Inquire about all potential costs, including benefits and administrative fees. Also, plan strategically for the countries you intend to hire in, as adding multiple countries can complicate the process.

Deel is actively developing new features aimed at becoming a comprehensive solution for US-based employers managing international hires. This ongoing evolution is geared towards creating a single platform that can accommodate a variety of HR needs.

Deel is exceptionally well-suited for SMBs to small enterprise businesses that need an efficient platform for managing contractors. It offers simplicity and ease of use that is ideal for businesses at this scale.

Larger companies may find Deel lacking in features necessary to manage a large employee population effectively, making it less suitable for bigger enterprises.

Remote

Remote is an excellent choice for distributed teams who require a top-notch payroll and benefits service. Their customer care is outstanding: 24/7 live chat, free HR tools, local experts for employers, plus technical support for workers. They also operate as local entities in more than 60 countries.

PROS

- Benefits plans are locally curated. Health, dental, vision, life, mental health support, and disability are all covered, as is pension/401(k).

- Local entity ownership helps Remote have more control over service costs, resulting in more flexibility in its pricing and service.

- Transparent rates. No markups on benefits premiums.

- Self-service features are easy to navigate.

- 24/7 HR support from regional experts.

- Option to provide equity-based compensation to employees.

- Fast and compliant payroll in 170+ countries.

- Live chat support with local payroll experts.

- Flexible, localized benefit packages.

- Flat-rate pricing structure, no deposits or hidden fees.

- Mobile app streamlines expense reimbursement with autofill from receipt photos.

CONS

- Remote currently offers no off cycle payroll, and only wire transfers and direct deposit are available.

- Lacks phone support.

- Very few pre-built integrations (Greenhouse, BambooHR, and HiBob). Companies will likely rely on its custom API to connect their current ATS and other HR tools with Remote.

- Doesn’t have a free trial.

- Redundant for organizations solely recruiting within the U.S.

- Help center documentation isn’t easiest to understand.

Remote helps distributed teams provide a better experience for their workers via country-custom benefit plans and easy-to-access employee self-service features. Remote is one of a few providers that owns legal entities in the regions where it offers EOR services, which gives them an advantage by greater flexibility in services and lower costs for its customers. Both of these are significant features that companies who use third-party aggregator services ll cannot offer.

Remote’s benefits are offered without premium markups, and they offer everything from paid time off to holidays, health care, and life insurance. Remote gives you access to region-specific advice and support to help you finalize your benefits plans.

Remote offers a 15% discount for eligible startups and nonprofits for up to 12 months. They also offer free service for up to ten employees for companies who hire refugees.

The apps, though well-made and frequently updated, were surprisingly hard to find online.

Both the Android and iOS apps are easy to navigate and have essential features like submitting expenses, booking time off, accessing payslips, and, according to Remote, there’s more in the pipeline.

Arduino, GitLab, Paystack, Loom, cargo.one, Secureframe, Phaidra.

- Contractor Management plan: $29/contractor/mo

- Employer of Record plan: $599/employee/mo (when paid annually)

- Global Payroll and Remote Enterprise plans: Custom prices – contact Remote.

- Startup and nonprofit discount: Eligible startups and nonprofits can get 15% off EOR and Contractor Management services for 12 months.

- Refugee discount: Up to 10 employees free when hiring refugees

Best For

Remote is best for teams with a globally distributed workforce. This tool makes it easy to hire, onboard, provide benefits for, pay, and retain top international talent.

It’s also a great option for startups, and nonprofits who can benefit from their 15% discount, and for those who hire refugees,

Remote is used by our firm to hire in locations like South Africa, Colombia and Brazil. We are able to use Remote as the Employer of Record and offer benefits just like they worked directly for our firm. You queue up the hire, Remote makes the offer in their system and makes all the employee information available via web portal. All expenses, benefits info, etc. can be accessed any time.

- Easy Onboarding - Remote does make onboarding hires in remote locations quite easy.

- Online Portal - great to have all the hires from all international locations in one place.

- Expenses - easy for employees and companies to track/pay expenses.

With a shortage of talent in the U.S., our firm needed to hire in locations where we did not have an entity. Global EORs offer a way to do that without setting up a legal entity first. Remote was an up-and-coming player in the space that made getting setup much faster, less complex than traditional partners like Velocity Global. We have used the system for approximately 2 years now.

- Billing/Invoicing - Remote has had multiple billing errors in our invoices and their system is incredibly confusing for reconciling what is outstanding vs. the errors they have made.

- Management - Remote has changed management recently and they have changed terms & conditions from our original invoices and have taken away promotions by saying they were "introductory promotions" rather than the "negotiated terms" like we originally discussed.

Remote was a leader in simplicity when we first began using their services a couple of years ago. Now, I believe certain competitors have caught up and surpassed them.

- Cash flow - these services require upfront payment for payroll so be prepared to pay month end payroll by the 17th of that month.

- Terminating employees - Employment laws vary country by country. Remote is offering a service to make it easier on your company to hire elsewhere; however, terminating employees can be quite difficult.

Remote was very startup friendly 2 years ago. Their management has changed and their culture has changed drastically. It is no longer a customer-focused culture going above and beyond to win customers.

Remote is good for an established company in search of a way to explore hiring people in other regions of the world.

Remote is not good for startups.

Paycor

Paycor is the go-to option for U.S.-based businesses because it goes beyond the average payroll and benefits solution by offering recruiting and employee performance in one place.

PROS

- Paycor is a very user-friendly payroll solution. The interface is simple and intuitive, and easy to navigate.

- The self-service employee portal lets employees access their HR information and benefits online.

- Offers multiple subscription options, making the tool more accessible to businesses of different sizes.

- No limit to the number of payrolls you run each month.

- Frequently runs discount offers with set-up fees waived on all plans.

- A free trial is available per request.

- Offers on-demand payment options in all plans.

- Accessible via mobile devices.

- Paycor payroll solution and mobile app are both straightforward to use.

- Intuitive self-service employee portal.

- Offers multiple modules for small businesses and custom plans for teams with 50-1000 employees.

- Unlimited payrolls.

- Offers discounts frequently. Though not listed on their site, a free trial is available to those who contact the support team directly.

- On-demand pay is available for all plans.

- With the acquisition of the people development platform Verb, it has improved its employee learning experience.

CONS

- Paycor offers various support options, including phone, email, and chat. However, they aren’t very responsive to customers’ queries.

- Undisclosed pricing.

- It provides time tracking as a paid add-on.

- The reporting functionality can be challenging to use, as data is sometimes unavailable.

- Can be challenging to customize the software if you have a unique set of requirements.

- Undisclosed pricing.

- Customer support is reported to be slow at times.

- It is not a good fit for teams with 1000+ employees or those requiring advanced customization to meet their unique requirements.

Paycor is featured here because it’s flexible and feature-rich. Users can purchase Paycor’s payroll alone and upgrade for onboarding, time-off management, and other HR functions as needed.

The first thing that caught our eye was Paycor's payroll. The solution can handle all-state and global payrolls, but please note that their global payroll services are outsourced to third-party services by location.

Available payment options are in pretty good shape. They offer on-demand pay, direct deposit, Paycor wallet, and access to Autorun, and each of these features is available on the basic plan.

Running payroll on Paycor is straightforward. The UI is simplistic, and navigation is intuitive for most users.

Employees can make benefits selections via the web or mobile apps. Both offer access to self-service payroll, onboarding, and attendance. As a security measure, changes to employee data are reported immediately to admin users.

However, rather than making this information available to any website visitor, Paycor only offers benefits guides, calculations, and other resources to their customers. Their data reporting capabilities left something to be desired, especially on the lower-tier plans.

Customer service being sometimes difficult to reach is also a disappointment, especially considering how critical prompt support is when it comes to payroll.

Wendy’s, McDonald’s, Detroit Zoo, the Cincinnati Reds, Chicago Fire FC.

Fees vary depending on the number of employees and features selected.

Best For

Paycor is particularly well-suited for organizations operating within the United States and employing up to 1,000 individuals. Its strengths shine particularly for sectors such as manufacturing, healthcare, food and beverage, nonprofits, and professional sports organizations.

I used Paycor for payroll administration and benefit processing. I used it daily for payroll, starting with the migration of biometric data into Paycor to capture clock-in/out punches. Paycor allowed me to monitor missed punches through a dashboard, which helped identify and resolve issues before processing payroll.

From an HRIS operations perspective, applicants were tracked, new hires entered their own onboarding information before their start date, and Paycor generated benefit enrollment information when employees became eligible. This workflow minimized the manual process of tracking and ensuring employees completed time-sensitive forms for benefits enrollment.

- Billing: Paycor billed per employee at an agreed-upon rate.

- Onboarding: The user-friendly process made it easy for new hires.

- Reports: The system provided the ability to run reports or request custom reports from a Paycor representative.

- Support: A dedicated representative was available, along with a support team if the primary rep was unavailable.

My organization purchased Paycor because it provided solutions for payroll and HRIS, including applicant tracking, onboarding, benefits, open enrollment, and performance management. I used Paycor for three years.

As the payroll administrator, I worked with Kronos to migrate biometric data (clock-in/out punches) into Paycor to process payroll. Additionally, I entered bi-weekly bonus payouts.

With Paycor, I also established a paperless open enrollment process and transitioned to an online platform. Paycor representatives assisted in setting up benefit vendor accounts for direct feed when payroll was processed, ensuring vendors received payment for employee benefits.

- System Issues: There were challenges with direct feed processing to vendors for payments.

- Support: The frequent turnover of dedicated reps made it difficult to establish continuity. Once we became comfortable with a rep, they would leave, requiring us to repeatedly acclimate new representatives to our business operations.

- Reports: The system did not allow data to be frozen in time for reporting. For example, if I ran a job title or salary report for 2003, it would display current data rather than historical information from that year.

The company transitioned from Paycor to Paycom. I prefer Paycom because it provides accurate historical reporting and has more consistent support staff.

Gather clear input from the departments that will use the tool the most to ensure it meets their needs. Ask the sales representative detailed questions—if they frequently need to check with someone else, they may not be knowledgeable enough about the product. Request a demonstration in demo mode to confirm that the tool will meet expectations and solve your specific challenges.

I have not used Paycor since the company transitioned to Paycom. However, since they are still in business, I assume they have made updates and continue to serve satisfied customers.

Paycor is well-suited for small to medium-sized companies with up to 150 employees.

Organizations with 500 or more employees may find Paycor insufficient.

Rippling

Rippling is a great choice for SMBs who want payroll to be a seamless and highly accurate process they don’t have to worry about.

PROS

- All-in-one platform for payroll, employee management + PEO services offered, and even a suite of other IT products

- With 500 integrations, they likely integrate with other key tools from your tech stack.

- All-in-one platform for employee management + PEO services offered, and even a suite of other IT products

- With 500 integrations, it’s very likely that they integrate with other key tools from your tech stack.

- Operates globally with any currency

- Workflow automation

- Analytics opportunities

- Provides a holistic view of company outflows—headcount costs included

CONS

- Very SMB focused

- Decent prices for the core HR tools, yet extra features (sold as add-ons) can be too pricey for some.

- Some shortcomings are reported with benefit carriers, and users may be limited to their partner ecosystem.

- Total buy-in to Rippling is essential

- Very SMB-oriented, in case you’re a larger company.

- New features tend to be buggy in ways that tech teams are not accustomed to fixing

Rippling was started by Zenefits alumni. They focus on helping small and medium organizations extinguish HR and IT busywork with one solution. The tool is built to be used, with ease, across every department.

Their product aligns with what you’d expect from a Silicon Valley-based startup: a great UI, eye-catching design, and fast performance. Notably, they have over 500 integrations (and counting) so they are likely to be able to meet any team where they are at, technically speaking.

Proxy, Dwell, Superhuman, Expensify, Checkr

Rippling’s pricing starts at $8 per month per user and will vary depending on which modules you’d like to use.

Best For

SMBs with a strong need for automation in HR processes.

We used Rippling as the source of truth for all HR reporting and documentation. The prior system we used did not have the storage and reporting capabilities to be our source of truth.

The key workflows we used were onboarding, offboarding, and document signature and retention. We were able to get most of the functionality we needed for these processes, but there were a few things that didn't work the way we needed them to without buying additional workflows.

There were some basic workflows, which were unlimited and free, but there were others that required upgrades and extra charges. The core plan included one workflow, so if you needed more than that, you had to purchase additional or upgrade your plan. The way that we set up our onboarding workflow (which was specific to location), we needed several workflows to accommodate our different locations, which was not a cost-feasible upgrade. Also, if you change the trigger on the free workflow, it changes to an upgraded workflow.

Rippling is user-friendly; you do not need to be a programmer to be able to program functions on this platform. You can contribute ideas for new features or functionality. Their customer service is better than most HRIS systems.

The organization had been using an HRIS system that did not have the robust reporting, automations, or customer service they were looking for. I used Rippling with the company for about a year and a half as a super admin. We found Rippling's customer service superior to the previous system we had been using.

Implementation was easy, but I strongly recommend that someone who has done implementations previously spearhead an implementation to help bridge where you were with a previous system to where you want to go with Rippling. Setting up workflows and automations is easy in Rippling, and their technical advisors are always willing to hop on a call to walk you through any issues that you may need additional help with.

We started using Rippling as the HRIS/payroll for our US team but quickly added the Canadian team. We used it largely for headcount and reporting for all other global teams.

Only one workflow in the core plan; everything else is an upgrade. Rippling often uses their customers for BETA testing without letting them know (Rippling told us they had functionality for payroll in another country when they did NOT). It feels like they are constantly trying to upsell you and get more money out of you.

The tool is one of my favorites so far. It is very easy to use, but when you get stuck on something, they will provide live support to walk you through. Most other HRIS systems are very helpful through implementation but are hard to reach once you have completed.

People need to think about the implementation process; the new tool is probably not going to look or act like the old tool. Definitely ask if there is a demo account and work through it to see how it works.

Think about where your company is now versus where you expect to be in five years. Will the tool grow with you? How much additional expenditure will be required to scale it with your business? If there are new functions you will need to purchase in the future, will the additional expense work with your scaling budget?

Rippling is very good at taking requests from customers for new functionality. For the most part, Rippling employees only know Rippling; they don't know other platforms. So they don't know how you used XYZ brand prior and how the change in process affected your business.

Rippling is good for organizations with a growing or evolving workforce. It can house all historical HR documents, send revised documents out with the click of a button, and update workflows easily.

Rippling would not be a good fit for a small, cost-conscious organization that doesn't need all the functionality it provides or would have to pay substantially more for the add-ons.

OnPay

We love OnPay because it takes less than one hour to setup and is the lowest cost option on the market.

PROS

- Free tax form handling for W-2 employees and 1099 contractors.

- Some HR services included within the plan at no additional cost.

- 30-day free trial available (starts after OnPay verification).

- Well-developed online help resources.

CONS

- Poor functioned employee mobile app.

- Requires payment four days before payday for direct deposit.

- Doesn’t support automatic payroll.

- Customer support sometimes hard to reach.

OnPay is perfect for smaller companies (500 employees or less) who want a simple and straight-forward payroll process, plus help with HR. Onpay customers love the customer service and the transparent pricing - it’s one monthly fee for everything. They offer benefits management in all 50 states including medical, dental, vision, and 401k retirement plans.

OnPay charges a base fee of $40, plus $4 per employee per month.

Best For

OnPay is a great solution for smaller, budget conscious companies that also want a basic HRIS in addition to payroll.

I use OnPay daily. The platform reduces the workload for my department, especially concerning taxes and payroll runs. It also provides in-depth reports on employee compensation, ensuring we stay updated on compensation compared to industry standards. The platform is very user-friendly and easy to teach to my colleagues in the department.

- It minimizes mistakes during payroll runs.

- It allows for unlimited payroll runs.

- I also appreciate the automated tax filings.

We were looking for software to help streamline our tax processes. OnPay offers an automated tax system that handles most of the work, and it also allows us to run unlimited payrolls. This feature was crucial for us since we have multiple shifts within our organization. With OnPay, we found that these two pain points became much more manageable. I have personally used this platform for over two years.

- I wish there was more flexibility in drilling down into specific reports.

- The company’s customer support could be better.

- The pricing structure could also use improvement.

The payroll runs and automated tax filings are two specific features that set OnPay apart from its competitors.

If you're facing increased payroll runs that add extra costs per month, I would certainly consider this platform for your organization. This feature handles most of the heavy lifting regarding payroll, saving you time and effort. The automated tax filings are also a significant benefit for any business looking to streamline this process, reducing the workload for your HR or Accounting/Finance departments.

From my experience, the overall customer service has improved significantly. Getting support when needed, even for simple questions, has become easier since I started using the platform.

OnPay is well-suited for any organization or industry, particularly small to medium-sized businesses.

Large corporations may not find OnPay the best fit.

Paychex

Paychex offers three different plans that can serve the needs of various types of small businesses, all focused on payroll processing and featuring some HR tools as you go up in range.

PROS

- Pay-as-you-go plans for various business scenarios.

- Plan upgrades offer enhanced features like performance management, employee screening, and benefits services.

- 48-hour onboarding with personalized payroll guidance for Select and Pro plans.

- Experienced payroll and benefits administrator for 740,000 US companies.

- Timecard processing can be fully automated.

- Integrates well with benefits providers like Benetrac for benefits management.

- User-friendly interface for reviewing W2s and paystubs.

CONS

- Users struggled to get timely help due to frequent payroll contact changes and long wait times.

- Some reported payroll errors and tax inaccuracies which caused compliance issues.

- Separate departments in Paychex for payroll, HR, and benefits hinder integration, customization, and support for small businesses.

- Limited third-party integrations.

- Some users reported slow app login.

- Less modern looking compared to competitors.

We quickly understood why Paychex is so popular among U.S. businesses after diving into its automations.

The auto payroll tax filing, for example, is nicely done. It can handle the whole tax filing process, which is super handy for multi-state teams in minimizing errors and avoiding penalties. Additionally, the employee onboarding feature is one of the most robust we have tried, with easy-to-complete online forms and personalized messages.

We also got a good impression of Paychex’s time tracking, as this tool not only supports touchless employee clock-ins but is agile enough for both medium and large teams.

On top of that, the availability of PEO services means Paychex users can gain access to specialized support for health benefits, compliance, and onboarding without the hassle of finding a whole new tool.

Paychex might be a bit trickier to use and get support than ADP but its strong automation focus is a boon and its HR tools are high quality.

However, if top-notch design is important to you, a fair warning: Paychex’s UI isn’t very good. Perhaps due to its abundant feature set, the payroll platform’s interface gives off a rather cluttered feeling.

Cluttered interface aside, we found the customer support team to be underwhelming. It's tough to get hold of someone on the phone and, when it comes to email support, this vendor can take hours and even weeks to respond. We're also not big fans of the frequent changes in Paychex's customer success managers' contacts, either. This, according to several users we spoke to, has made it even tougher to get assistance.

740,000+ companies, including ESET, Funnelbox Inc., Smile Cafe, H.Y.P.E. Counseling Services, ASG, and Pet Partners.

Paychex pricing starts at $39 per month, plus $5 per employee per month.

Best For

Medium and large-sized U.S. businesses face the intricacies of employing and paying workers across state lines.

I primarily use Paychex in my HR role to run payroll and track employee hours. I also onboard new employees and send out necessary forms through the platform. Additionally, I manage leave balances and communicate important dates and upcoming holidays with employees. This program allows me to send documents for employee signatures as well. I use it regularly to ensure smooth HR and payroll operations.

Paychex is easy to use and has an aesthetically pleasing interface. I appreciate the communication features it offers. My favorite part is being able to manage payroll, timekeeping, and document distribution all in one place.

My organization wanted to cut costs and upgrade our payroll system. After reviewing several options, we chose Paychex primarily for its features and pricing. This program allows us to create user profiles for as many administrators as needed. Training was also a challenge for us, but Paychex provides tutorials and a dedicated 1-800 support line. I have personally used it for over three years.

There isn’t much I would change. However, having a dedicated account manager to meet with directly would be helpful. I do appreciate the dedicated 1-800 support line and quick response times.

I prefer the ease of use and navigation of Paychex over its competitors. I also appreciate the mobile applications and the integrated chatbot for quick support.

You should consider how much time you want to spend managing payroll and HR tasks within the app. It’s important to decide whether you prefer a software-based solution or outsourcing to a payroll company. Additionally, determine whether you want to handle IRS payments and tax filings yourself or have them managed by the service.

The biggest improvements over the years have been the addition of job posting features and salary benchmarks. The AI chatbot has also been a great addition, helping me find quick answers efficiently.

Paychex is well-suited for small to medium-sized businesses.

Paychex may not be the best fit for larger organizations with high turnover rates or frequent new hires.

QuickBooks

Quickbooks is a trusted name in financial tracking, payroll, expense reports, and even time and attendance software for small businesses.

PROS

- Unlimited pay runs, auto full-service payroll, and same-day deposits included.

- Supports unscheduled payrolls and automatic year-end tax filings.

- Reminders for tax readiness provided.

- Pricing transparency. 30-day free trial available.

CONS

- No employer app.

- More expensive than some competitors like Patriot.

- Limited third-party integrations.

- No global payroll features.

Many small businesses use Quickbooks for their accounting and financial reporting. They know that small business owners may not have enough time to be doing payroll, so their solution focuses a lot on running things automatically and freeing up your time. The same goes for taxes, as they'll calculate, file, and pay your payroll taxes for you, in some cases.

For payroll, Quickbooks has three plans:

- Core: The basics to pay your team and have payroll taxes done for you at $22.50 per month

- Premium: Manage your team's payroll with HR support and some employee services for $37.50 per month

- Elite: This plan provides access to on-demand experts in order to simplify payroll to the max. It starts at $62.50 per month.

QuickBooks often offers discounts for its plans. They currently have a 50% discount on all plans for the first three months of subscription.

Best For

SMBs with a fairly simple payroll structure but little time to handle it all themselves.

We use Quickbooks for all of our invoicing needs, as well as for AR reporting when needed. We can also keep track of all of our contacts in the vendor section which makes it an easy place to go if we need information.

- User-friendliness is the main pro we find when using Quickbooks.

- It’s been very easy to train my HR employees how to send and receive invoices.

- It’s linked to our bank.

- It gives the option for people to pay via ACH when sending out invoices (easy for them to pay with a touch of a button).

When my organization was looking for options to help quickly get out invoices to our clients they thought Quickbooks would be the perfect solution. We have now successfully been using Quickbooks for 10 years for our invoicing needs as well as AR reporting which helps our HR team run smoothly.

- Sometimes it runs slow if more than one user are in the software at a time.

- Connectivity issues will happen at times which could make it frustrating to use when you are in a hurry.

- You have to add in other apps to be able to use all the functionality of Quickbooks and pay further pricing.

The only other software we have tried in the past was NetSuite, and we ultimately decided to go with Quickbooks due to its pricing and ease of use. NetSuite did have more functionality but overall we liked the way Quickbooks worked with our company’s needs.

They should figure out what they specifically want to use the tool for, and make sure they do their research and pick the correct type of Quickbooks so they can easily work through what they need to get done.

The website itself has changed over the years but in a good way! We feel it is super easy to navigate and works for our business needs.

Really any corporate type of business that needs to send invoices out to customers, our organization does staffing and recruiting and we rely on Quickbooks to be able to send out invoices to clients.

Maybe manufacturing companies or just very small, less than 10 person companies might not benefit from QuickBooks online.

Paycom

Paycom offers online payroll services and HR software solutions for both big and small businesses to manage the entire employment life cycle.

PROS

- Paycom's payroll system is easy to use and customize.

- They now have a Global HCM offering with the aim of expanding access to users in over 180 countries.

- Customers have praised the responsiveness of the support team and their willingness to help with any issues that arise.

- Paycom assigns each account a dedicated rep who can provide support and answer questions.

- Paycom is constantly updating its software with new features and improvements.

- It has a reasonably functioning mobile app.

CONS

- Paycom does not integrate directly with QuickBooks, so users that use both systems must manually enter data into Paycom.

- Some customers have experienced slow access to tax reports.

- Some of the members on the customer support team are new and at times, don’t have answers to questions or solutions to issues.

- Paycom price has increased in recent years.

- No free trial.

- Integrations are limited.

We recommend Paycom for medium to large businesses since the platform provides payroll and HR solutions, which from our experience, are comprehensive and user-friendly.

Paycom impressed us with its guided self-service technology, Beti, which is accessible on browsers and mobile devices. The Android app received positive feedback for its user-friendly interface and comprehensive employee self-service features, including time clock punching, time-off requests, accessing pay stubs and benefits, reviewing paychecks, and submitting receipts for reimbursement.

As an admin, you can customize employees’ access to these features and manage HR tasks on the go. Employees have control over their HR data, including earnings and personal details. However, Paycom currently offers only direct deposit and paper checks, with no available pay card option.

While originally focused on serving the U.S. market, Paycom has expanded its reach with the introduction of their Global HCM, enabling users in over 180 countries to access its services. This enhancement demonstrates Paycom's dedication to addressing the needs of global teams, further solidifying its value-for-money proposition.

While Paycom has its strengths, we noticed there are a few areas where it falls short. Integration options remain limited, relying solely on API integrations, which can prolong implementation and require IT involvement. The connection with third-party software, like QuickBooks, is not seamless, resulting in manual data entry. Additionally, customer support quality varies, with some representatives lacking system knowledge, leading to delayed issue resolution or multiple follow-ups.

The pricing of Paycom’s plans isn’t disclosed on the website. You do have to contact their sales team to get a custom quote.

Best For

Paycom’s full-service payroll makes it a great solution for midsize and large businesses to have a full suite of payroll and HR services.

I used Paycom every day. I utilized the electronic personnel files that helped ensure that I had all onboarding documents correct during this process. I also used the recruiting function. I had many hires and Paycom offers a great function to keep track of all of your recruiting needs. Including where you are at in the interview process, applications, interview questions, and many more!

I love the aspect of streamlining Paycom and Payroll. Another pro to utilizing Paycom is the electronic version of personnel files. The recruiting tool in Paycom is another great tool to help with any organization's recruiting and hiring needs!

Our organization originally did not have a HRIS system. One of the major selling points to the organization is that Paycom offers a seamless transition to make all of our HR personnel files digital along with many other HR options to help streamline all HR processes. In addition, we added a function within Paycom to ensure our payroll was efficient and easy to work through each pay period. Paycom also offered our hourly employees an app to help make it easier to clock in and out during the work shift. This was a key function as many employees were offsite and other locations other than headquarters.

There has been a few times were the dedicated account manager took longer to get back to specific questions that I would have liked.

Paycom offers a lot more functionally. The implementation process was not too difficult company-wise. And the price is a vary fair investment.

If your organization is thinking about utilizing its first HRIS system. If your company wants a user-friendly payroll system.

It has added many functions, including pieces of training, performance reviews, and tracking attendance.

Any organization that is mid-sized or a corporation.

Smaller businesses

PapayaGlobal

Papaya Global stands out in the realm of payroll software for enabling seamless, secure payments to contractors and employees in 160+ countries, backed by robust security and compliance measures.

PROS

- Papaya ensures prompt payouts within 72 hours across 160+ countries.

- Transparent pricing with a 60-day money-back guarantee.

- Dedicated customer success managers in your time zone, providing localized assistance without extra charges.

- The starter monthly fee is reduced to $12 per employee for full-service payroll.

- Offers comprehensive solutions (data and insights, benefits, immigration, payment services, employee data management) at an accessible entry price.

- Papaya Global packs the EOR services you need to do global payroll and employment compliantly in over 160 countries.

- Automated payments in over 100 currencies, 80 of them directly to the worker's bank account through its global banking partners.

- Dedicated customer support providing locations-specific knowledge regarding employment and payroll.

- End-to-end payroll guaranteed payouts in 72 hours.

- Offers four standalone solutions: data and insights, supplemental benefits & immigration support, payment services, and employee data management, making the platform more affordable and scalable.

CONS

- Lacks local entities in service countries; no tax penalty guarantee information available.

- No free trial or plan is offered.

- Additional fees include setup, onboarding, cycle per employee, year-end fees, and a required deposit.

- Limited existing integrations, but free use of pre-built APIs and custom API integrations.

- No free trial or free plan.

- Doesn’t own entities in all the countries it serves. The platform forms relationships with existing local in-country partners to handle employment in a specific region on the client’s behalf.

- BI analytics reports and global immigration services cost additional fees.

- Charges extra fees for setup, onboarding, employee cycle, and tax filing. Also requires a refundable deposit.

- Built-in integration options aren’t very robust. However, the platform does offer pre-built APIs, SFTP, and custom API integrations for free.

Papaya Global is highly favored by both users we've engaged with and our editorial team. We’ve been familiar with the tool since early 2021, and it immediately stood out for its transparent pricing, comprehensive HR tools, robust BI analytics, and local customer support.

The platform caters to employers and staff alike, providing unified access to payroll, payments, and workforce analytics. It ensures automated payments in local currency, customized benefit packages, and multilingual pay slips across 160+ countries. Additionally, AI-powered engines scrutinize invoices for precision.

In-house benefits experts are at your service for location-specific advice at no extra cost. Employees benefit from a user-friendly self-service portal for onboarding, time off requests, document checks, and payslip reviews. The recently launched mobile app (as of February 2023) offers even greater accessibility, allowing access to payment calendars, bank details, and company announcements on the go.

They also offer a unique global equity management feature, enabling equity distribution to employees, regardless of location. The platform excels in providing dynamic visual insights for payroll and HR, billing, and administrative data.

There are critical factors to consider when evaluating Papaya Global for your company’s needs. For example, depending on the service region, Papaya may or may not have its own local entity set up, which means they will rely on third-party local partners. Additionally, though pricing transparency is a strength, additional expenses like setup fees per location, onboarding fees, cycle fees per employee, year-end tax filing fees, and a refundable deposit should be considered. We advise evaluating and outlining all the ins and outs specific to your team’s needs and then meeting with Papaya Global’s team for a comprehensive quote tailored to you.

Fiverr, Toyota, Wix, Deezer, Intel, Johnson & Johnson, Microsoft

- Full-Service Payroll service: Starts at $12 per employee per month, with flexible options based on operational needs.

- Payroll Platform License service: Begins at $3 per employee per location for tech upgrades.

- Data and Insights Platform License service: From $150 per employee per month, offering real-time analytics on payroll costs and headcount.

- Payments-as-a-Service service: Starting at $3 per employee per month, delivering a dedicated workforce payment platform.

- Global EOR plan: Ranges from $650 to $1000 per employee per month for comprehensive EOR management.

- Contractor Management & IC Compliance plan: Tailored services for outsourced contractors, starting at $2 per contractor per month.

- Global expertise services: Starting at $190 per month per employee, this lets you add the global health plan, immigration support, and global equity for employees.

Best For

Papaya Global is a good choice for streamlining global payroll and benefits operations in countries with established entities. It's particularly valuable for businesses with international hires within Papaya Global’s extensive country coverage.

We started by using the payroll functions to consolidate our global payroll teams into a single platform that headquarters could manage. The success of this initiative led us to expand our use of Papayaglobal, incorporating additional functions such as global recruiting and the employer of record service. This allowed us to streamline our employee experience across all locations. Eventually, we added the employee portal feature, further enhancing the consistency and efficiency of our HR processes worldwide.

- The tool ensures compliance with employment legislation across different countries.

- It handles payroll functions, including currency and tax laws, specific to each country.

- The platform provides a unified experience for all employees globally, which can be managed from a central location.

The organization I worked for needed to streamline its payroll and HR platform to cover all global locations. We were struggling to manage payroll efficiently while complying with various employment laws. The financial burden of maintaining multiple teams to oversee these functions was also a concern, as it was costly to ensure accuracy and compliance. Payroll was our primary focus, so we sought a platform that could handle these tasks without requiring a large, expensive team in each country. We have used this tool for several years now, with significant improvements in efficiency and cost savings.

- The primary support is via chat, which can be inconvenient during urgent situations.

- The cost might not be suitable for startups or small businesses.

- The learning curve is steep for large companies, requiring significant time to implement and integrate fully.

Papayaglobal offers a globally integrated service that ensures compliance with employment and tax legislation. Compared to similar tools, it is user-friendly once you become familiar with it. The ability to manage all employee functions from headquarters on a single platform distinguishes it from others, making it a valuable investment.

Papayaglobal is ideal for large companies with multiple global locations seeking a unified platform for HR and payroll management. It is particularly beneficial if you want to manage these functions centrally while providing a consistent experience for all employees.

Papayaglobal has become more user-friendly and has expanded its support options. It now offers more integrations with other software, making it even more versatile and useful.

Papayaglobal is excellent for large, multi-location organizations. It is particularly useful for companies with global operations looking to consolidate HR and payroll functions into a single team at their headquarters.

Papayaglobal may not be suitable for startups or small businesses with limited locations. The cost may outweigh the benefits for smaller operations. However, it could be worth considering as part of a global expansion plan.

Namely

Namely provides a quick and easy payroll solution with modern design and UX. Their all-in-one HR platform can be used by any company really, though they pay close attention to mid-market companies.

PROS

- Namely's user interface is highly praised by users. It is clean and quite intuitive despite the platform's comprehensive feature coverage.

- The employee onboarding module includes a user-friendly wizard that effectively guides new hires through necessary steps and tasks.

- Along with Namely’s built-in features for data management, recruiting, onboarding, time off tracking, payroll, and benefits administration, Namely offers managed payroll and benefits administration services for those needing extra assistance.

- The majority of users are able to navigate Namely without any issues. They find the UI to be intuitive and clean, despite the fact that the platform has lots of features.

- Namely’s employee onboarding module gets a alot of praise from users. It features an easy-to-follow wizard, which helps new hires get on quickly and be clear on what they need to do.

- Besides the platform’s built in features for data management, recruiting, onboarding, time off tracking, payroll and benefits administration, there are also managed payroll and benefits administration services you can opt for to reduce the burden on your internal teams.

CONS

- Namely primarily caters to U.S.-based companies, which makes it unsuitable for organizations needing to manage pay and benefits for employees in other countries.

- The implementation process of Namely can be time-consuming, typically taking a minimum of 6-8 weeks.

- Despite how big of a player Namely is in the HR space, it lacks employee development features like skill training, career pathing, and succession planning.

- Before purchasing Namely, it is essential to ensure compatibility with your current benefits provider, as there have been reported instances of Namely's team encouraging users to switch to more expensive providers.

- Namely primarily operates in the U.S., which means if you’re looking for a global payroll and benefits provider, this platform isn’t for you.

- Though many praise the platform’s ease of use, it does take long to implement it. Namely’s own team says that an average implementation takes between 6-8 weeks.

- For a platform of Namely’s size, there currently aren’t any features that focus on employee development such as skill training, career pathing, succession planning etc.

- You’ll need to check beforehand if Namely can work with your existing benefits provider, if you have one. There have been a few reports (but not few enough to ignore) about Namely’s team convincing customers to change their benefits provider to providers that charged them more.

%202.10.05.png)

Namely’s all-in-one platform comes with a payroll module for processing salaries on time and without any errors. It can help you with a lot, including calculating wages, deductions, and taxes, and generating pay stubs for your employees. The platform is also always up-to-date with the ever-changing payroll regulations and tax laws to ensure you don’t get penalized and that everything pertaining to your employees’ payments is above board.

We like any product with employee self-service features and Namely checks that box of ours. Your staff can log in to a dedicated dashboard to access and manage their payroll information, update personal details, and view pay stubs whenever needed. Namely also packs a robust reporting module to get a holistic view of your company’s payroll and valuable statistics to make informed decisions.

Greenhouse, Bevi, and Workwave are among Namely’s 1000+ customers.

Namely has custom pricing that varies according to the extent of your need. You can contact the Sales team for an estimate.

Best For

Namely predominantly serves mid-sized companies across different verticals.

I used Namely for every payroll of course, but also onboarding staff and making sure they are set up in payroll. Additionally, things like getting employees data regarding payroll such as w2s was much easier. It was especially helpful that our staff can self-serve, which in a company with a small HR department is critical. It was really easy for them to learn, and employees are able to enter PTO requests and track their balances without having to reach out to an HR professional. So that feature was used throughout the company every week. Also, the social feature was appreciated by the staff, such as seeing coworkers' birthdays and anniversary, so they can congratulate and interact.

I really liked the fact that our staff, who had never used any kind of HRIS before, was able to pick up on this so easily and didn't have trouble or need intensive instruction. I also liked the degree to which they were able to solve problems and access information on their own. I also felt the onboarding features were robust and easy to use.

At the time we switched to Namely we didn't have an HRIS and were manually doing everything from onboarding to payroll. Since we were growing, we needed a proper system. It definitely made things like reporting and providing employee data far more efficient and accurate. Also, the onboarding process was easy and saved a lot of time and prevented overlooked details and errors. The staff also liked using it and clocking in and out became easier with fewer mistakes. Once it was all set up, running payroll, making payroll changes, and accessing payroll records was much faster, easier and problems became rare. I used it for a year.

When I needed customer service, it wasn't the best I have ever experienced or the quickest, with a lot of different representatives involved of varying knowledge and understanding. I think better built in help resources would improve the product overall. I didn't find the benefits administration easy to use either.

I have used many similar tools and feel like Namely is a solid system compared to similar products. I don't think it is the very best, as it did lack some features such as an ATS, but for a smaller company these may not be as needed. The ease of use was a bit better than others, but the customer support needed improvement. Overall, I was happy with it.

People should consider what features they may need, and compare them to similar tools, since there are similar products with more features. Also, they should consider the size of the company, since Namely is best for small to medium sized organizations. If people are without any kind of tool like this, they should consider the cost involved is worth the many efficiencies they will gain from employing Namely.

In the time I used Namely, I think they did improve the customer service somewhat, which was a problem in the beginning. This is important because the work done in Namely is often time sensitive, such as payroll, and problems can have a major impact on staff, so customer service is critical.

I think this is perfect for small companies with employees who need an easy-to-use tool. It is great for companies who have never used a system like this before because the user interface is very intuitive.

Very large companies that do a great deal of hiring may find Namely not robust enough and lacking in certain features.

Why Payroll and Benefits Software?

There are a few apparent use cases for payroll and benefits software. However, we also wanted to explain some of the benefits that may not be as self-evident. Here is the “why” behind buying new payroll and benefits software:

- Pain-free payroll: These solutions will run payroll for you in a streamlined way that reduces your time and effort. To teams using outdated systems or completing operations manually, this could mean hours or even days saved per pay period.

- Simplify health benefits: These solutions guide you through the benefits selection process, sometimes with a trusted consultant who recommends packages that fit your company well. Your employees can then choose which option is right for them during open enrollment, qualifying events, or onboarding.

- Access to experts: Managing benefits and payroll internally can be complicated, especially if this is not your day-to-day focus. You must be aware of and keep up-to-date with a wide range of regulations and requirements, as they can change frequently! To assist with this, the best benefits and payroll solutions offer day-to-day customer support and will work closely with you when making strategic decisions and regulatory updates.

- Access to better health plans: The best payroll and benefits solutions provide you with greater access to competitive employee benefits to create a package that makes the most sense for your employees. You will also be able to compare plans from different providers more easily and therefore ensure you have selected the best package for your business’s needs.

- Cost-effective: Using an external vendor for payroll and benefits will help decrease the number of employees you need for this function and help save on costs in technology, support, and training.